Fidelity, a prominent financial institution, has recently filed to establish an exchange-traded fund that will hold Ethereum's ether (ETH). This move aligns them with BlackRock, another major player in the industry, as they both continue to expand their involvement in the world of cryptocurrencies.

Fidelity, BlackRock, ETH ETF Insights

- Fidelity has joined the ranks of major firms in pursuit of an ETF for Ethereum.

- The SEC is also currently considering numerous applications for a Bitcoin ETF.

- An approved ETF would enhance accessibility for those looking to invest in crypto.

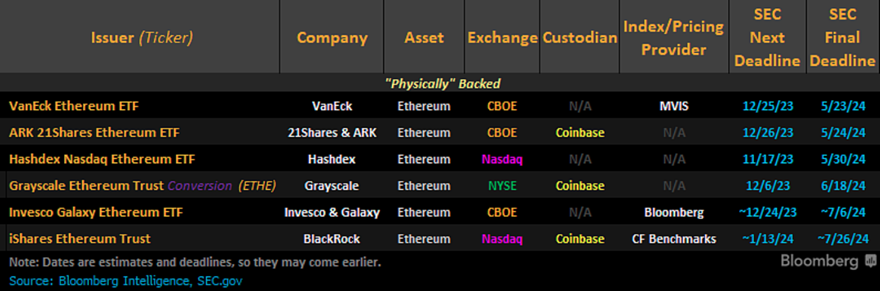

An exchange owned by Cboe Global Markets has announced the listing of the Fidelity Ethereum Fund, as per the filing made public. However, the U.S. Securities and Exchange Commission has yet to approve the proposed ether ETF, along with others such as BlackRock's, which was disclosed earlier this month.

Fidelity and BlackRock are both interested in developing exchange-traded funds (ETFs) that would provide investors with convenient means to invest in a larger cryptocurrencies, specifically Bitcoin (BTC) and Ethereum (ETH). The Securities and Exchange Commission (SEC) has not yet expressed its opinion on these proposals.

Fidelity's ETF application now sits on SEC Chairman Gary Gensler's' desk along with the paperwork for Grayscale, ARK, VanEck, Hashdex and Invesco.

According to proponents, the inclusion of BTC or ETH, the largest cryptocurrencies, in ETFs has the potential to significantly disrupt the crypto market. Unlike cryptocurrencies, ETFs are generally more accessible for purchase as they can be obtained through a traditional brokerage account.

These ETFs function similarly to stocks and mirror the performance of various assets, ranging from the overall stock market to commodities like gold, corn, and sugar. This accessibility, coupled with the influential reputation of renowned companies such as Fidelity and BlackRock, could attract a substantial influx of new investment capital into digital assets.