Bitcoin exchange traded funds (ETFs) from BlackRock and Fidelity have rapidly accumulated substantial crypto holdings, totaling over $6 billion worth of BTC.

As major financial players continue entering the digital asset sector, these Bitcoin ETFs exemplify growing institutional adoption. However, questions remain regarding crypto's regulatory outlook and market volatility.

Surging Interest from Financial Giants

In recent years, Bitcoin and cryptocurrencies have transitioned from fringe technologies into more mainstream asset classes. This shift became especially pronounced in 2021, as major banks and financial institutions waded into the nascent crypto sector. Two companies leading this institutional charge are BlackRock and Fidelity.

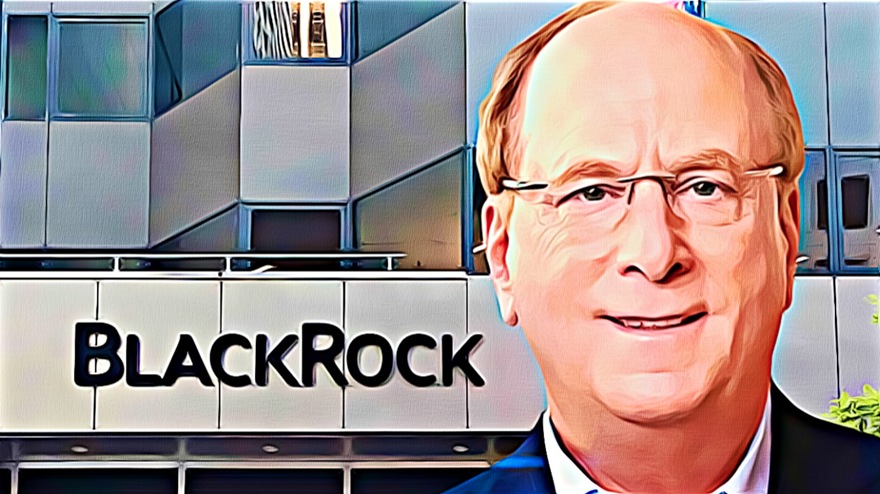

BlackRock's Blockchain Bet

BlackRock is the world's largest asset manager, overseeing a staggering $10 trillion in global investments. While the firm has historically avoided significant crypto exposure, 2022 saw BlackRock aggressively pivot into blockchain technologies.

In January, BlackRock filed applications for several potential spot bitcoin ETFs. By August, they launched their first blockchain ETF (BIDS) targeting crypto infrastructure and service providers. BlackRock also partnered with Coinbase to enable institutional clients broader access to cryptocurrency trading, custody, and prime brokerage services.

In January, BlackRock filed applications for several potential spot bitcoin ETFs. By August, they launched their first blockchain ETF (BIDS) targeting crypto infrastructure and service providers. BlackRock also partnered with Coinbase to enable institutional clients broader access to cryptocurrency trading, custody, and prime brokerage services.

“We are seeing interest from some institutional clients in how they think about digital currencies so it’s an area of interest, it's small, but it's a real interest."BlackRock’s CEO, Larry Fink

Fidelity's Expanding Digital Assets Business

Fidelity Investments currently administers over $11 trillion worth of customer assets. Like BlackRock, the multinational financial juggernaut sat out previous crypto rallies before embracing Bitcoin in 2022 through ETF offerings.

In April, Fidelity filed for a spot bitcoin ETF and later launched their Wise Origin Bitcoin Trust. Fidelity also unveiled crypto trading for retirement accounts like IRAs and 401(k)s. Abigail Johnson, Fidelity’s CEO, stated, “We’re believers in the idea of a tokenized, decentralized economy.”

Billions in Crypto Fund Inflows

The combination of BlackRock and Fidelity's Bitcoin ETFs has quickly amassed extensive crypto holdings. As of November 2022, total assets under management (AUM) for these funds exceeded $6 billion. Specifically:

- BlackRock's Blockchain ETF (BIDS) hit $1.32 billion in AUM

- Fidelity's spot Bitcoin ETF surged to $4.8 billion in AUM

For context, the largest crypto asset manager Grayscale recently controlled about $20 billion worth of digital assets. If sustained, however, BlackRock and Fidelity’s ETF inflows put them on track to soon rival Grayscale’s holdings.

Factors Driving Adoption

Several key factors help explain BlackRock and Fidelity expanding crypto involvement. These include:

1. Client Demand

Surging client demand is motivating major financial institutions to increase crypto asset offerings. Particularly among younger investors, cryptocurrencies like Bitcoin are seen as attractive portfolio diversifiers.

To remain competitive, companies like Fidelity and BlackRock are responding to shifting consumer preferences with expanded digital asset access. As noted by one manager at BlackRock:

"Crypto is transformational, disruptive tech that is driven by huge customer and client demand based on my conversations over the past year."

2. Market Opportunity

As cryptocurrency markets continue maturing, Wall Street sees immense profit potential servicing this nascent sector. Conservative estimates place the current value of digital assets around $900 billion - but future projections are far higher.

Some bullish forecasts envision crypto's total market capitalization exceeding $20 trillion by 2030. This represents a 20X increase, significantly outpacing expectations for already established markets like stocks or real estate.

Crypto's high growth prospects make early involvement appealing. Hence financial services heavyweights like BlackRock and Fidelity want crypto/blockchain initiatives established before markets experience more extensive mainstream adoption.

3. Mainstream Legitimization

For years skeptics dismissed cryptocurrencies as speculative hype bound to crash. Yet Bitcoin and stablemates have shown impressive resilience, gaining more widespread credibility in recent years.

In 2021 El Salvador introduced Bitcoin as legal tender while the crypto sector reached nearly $3 trillion in value. Mastercard, Visa, PayPal and other fintech giants now interface with crypto systems. Even nations like China who once banned cryptocurrencies are now pivoting to accept blockchain-based CNY.

As digital assets earned greater legitimacy worldwide, institutional trust in cryptocurrencies improved considerably. More mainstream acceptance diminished previous stigma hindering major financial services involvement.

Lingering Concerns

While BlackRock and Fidelity's crypto ETFs highlight increasing institutional adoption, uncertainties remain regarding broader blockchain integration.

Volatility Worries

Cryptocurrencies are notoriously volatile compared to traditional assets. For example in 2022 Bitcoin plunged nearly 60% approaching $17K after nearing $69K highs in late 2021. These extreme fluctuations keep risk-averse institutions sidelined.

Many companies also fear reputational damage if clients face heavy losses investing in such an unpredictable niche. While volatility could ease long-term, it remains a near-term obstacle limiting more significant institutional participation.

Unclear Regulations

Cryptocurrencies currently operate in an ambiguous regulatory gray zone internationally. There are complex jurisdictional considerations governing taxation, securities law, banking integration, contract enforcement and other issues pertaining to digital asset adoption.

Absence of clear legal guardrails makes wide-scale blockchain incorporation dicey from compliance and liability standpoints. Until crypto oversight improves, institutions lean toward restraint adopting emerging Web3 technologies.

While SEC Chairman Gensler affirms “crypto is here to stay” concrete policies remain lacking and enforcement seemingly arbitrary, especially regarding crypto lending/staking products. This regulatory uncertainty introduces risks chilling widespread institutional enthusiasm.

Looking Ahead

Despite lingering volatility and legal issues, Fidelity and BlackRock's multi-billion dollar Bitcoin ETFs exemplify crypto's accelerating mainstream traction. As blockchain technologies continue maturing, more institutional stalwarts will likely add cryptocurrencies to client product menus.

To attract apprehensive investors however, the crypto industry must keep improving security, transparency and consumer protections. Additionally, clear regulatory frameworks internationally are needed so institutions can confidently integrate digital assets without compliance ambiguities.

If solutions emerge mitigating crypto's structural risks while upholding innovations, expectations are extremely bullish. Some analysts forecast over 90% of financial services companies will provide tokenized asset offerings by 2030.

For any still skeptical, Larry Fink’s advice is clear:

“You need to have some exposure to cryptocurrencies in a portfolio.”

So as major players like BlackRock and Fidelity onboard crypto, smaller rivals may soon face hard choices - either follow quickly or risk getting left behind altogether in the race towards Web3.

Could crypto integration remake finance like the internet transformed media?